how much taxes will i owe for doordash

Typically you will receive your 1099 form before January 31 2022. If youre a Dasher youll need this form to file your taxes.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Well go over tax forms when to file and how to get your lowest possible tax bill.

. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. If you live in a state with income taxes youll also need to file a state tax return. The forms are filed with the US.

You can save a ton of money with PayPal. As such it looks a little different. Its really simple to calculate your deduction.

That money you earned will be taxed. The amount of tax charged depends on many factors including the following. To compensate for lost income you may have taken on some side jobs.

An independent contractor youll need to fill out the following forms. There is no federal income tax owed until youve made over 12400 in 2020 so the only thing youll owe is about 15 for Social Security and Medicare which will help you get future benefits. If you know what your doing then this job is almost tax free.

It also includes your income tax rate depending on your tax bracket. You will also need to pay a self-employment tax. Heres your complete guide to filing DoorDash 1099 taxes.

Expect to pay at least a 25 tax rate on your DoorDash income. A 1099 form differs from a W-2 which is the standard form issued to employees. Its only that doordash isnt required to send you a 1099 form if you made less than 600.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. This method is known as itemizing. The location of the store and your delivery address.

Generally you can expect the IRS to impose a late payment penalty of 05 percent per month or partial month that late taxes remain unpaid. To file taxes as a DoorDash driver aka. This includes miles that you drive to your first delivery pickup between deliveries and back home at the end of the day.

Best Times To Doordash Reddit At Best Doordash Support Ladies And Gentlemen R Doordash See How Much Doordash Drivers. Im projected to make about 35000 this year and ill probably owe 5k. How much do Dashers pay in taxes.

If you dont pay the quarterly estimated taxes you will be fined a small penalty when you file your taxes by April 15th. There are various forms youll need to file your taxes. For 2020 a single person can.

In 2020 the rate was 575 cents. If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes. Apr 02 2021 Thats for income tax and.

In this case its a 153 tax that covers what you owe for Social Security and. It will look something like this. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

DoorDash dashers will need a few tax forms to complete their taxes. If you made 5000 in Q1 you should send in a Q1 payment voucher of 765 5000 x 0153. Ad Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job.

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. Alternatively you can keep track of your vehicle. If the 1099 income you forget to include on your return results in a substantial understatement of your tax bill the penalty increases to 20 percent which accrues immediately.

Im only paying 900 in taxes on my DoorDash earnings after making 26k last year. Collect and fill out relevant tax forms. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

Generally you can either take a standard deduction such as 6350 if youre filing 2017 taxes as a single person or you can list each of your deductions separately. The date and method of fulfillment. All you need to do is track your mileage for taxes.

Itemized deductions are reported on Schedule A. It doesnt apply only to DoorDash employees. Doordash will send you a 1099-NEC form to report income you made working with the company.

But SE tax isnt supplemented by an employer in your case so you will have to pay the full 153 of your net income for that. 2 days agoAs of December 2019 DoorDashs revenue is 0 Million. Taxes apply to orders based on local regulations.

The general rule is if you are expecting to owe the irs 1000 or more when you file your taxes then you have to file 4 times a year instead of once. This includes 153 in self-employment taxes for Social Security and Medicare. DoorDash Tax Forms.

If you expect to owe the IRS 1000 or more in taxes then you should file estimated quarterly taxes. Mileage or car expenses. DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip.

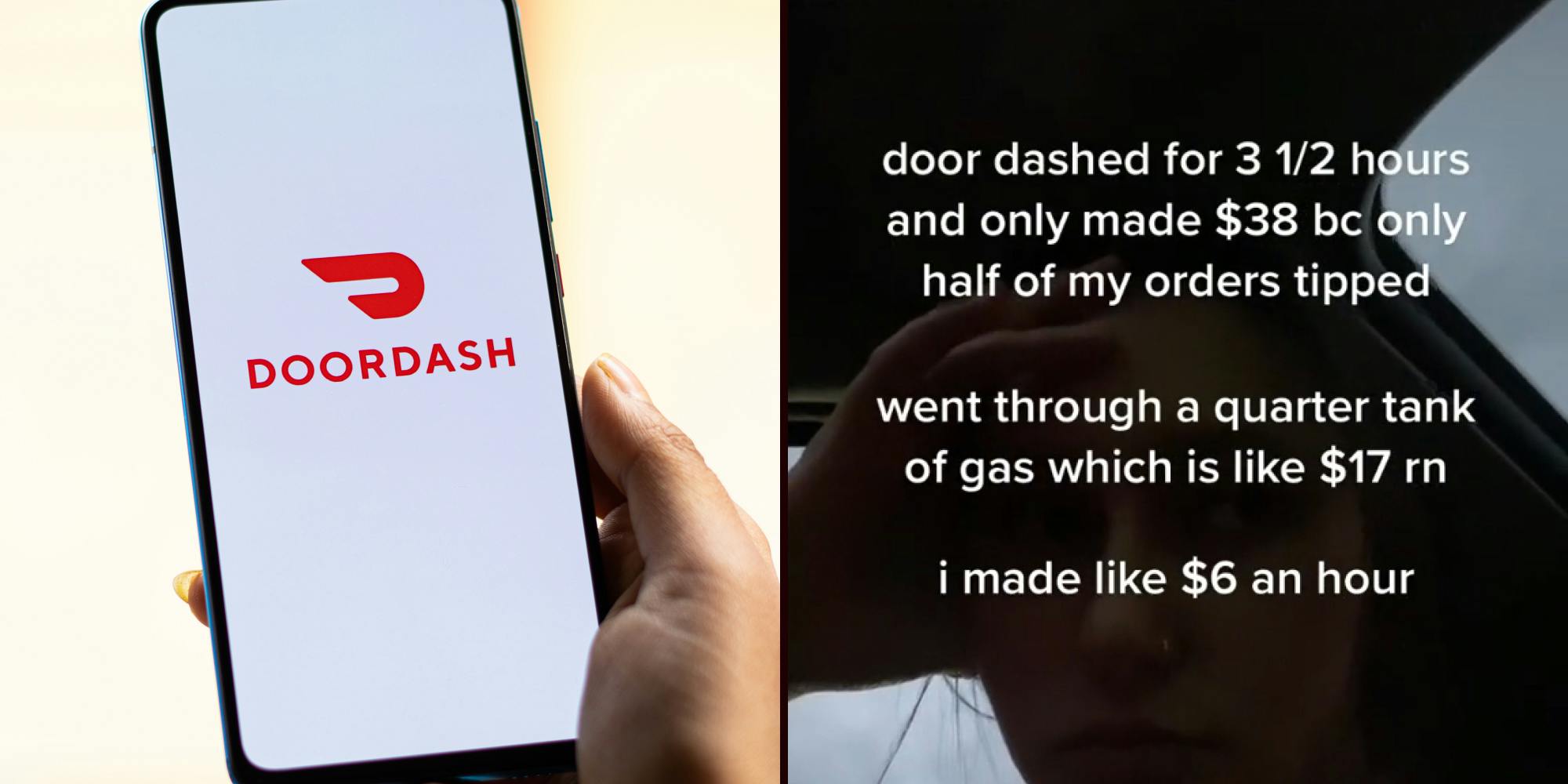

If the 10k is the only income you are reporting on your tax return you would not be subject to income tax. I made about 7000 and paid maybe 200 in taxes after all the deductions. One of the best tax deductions for Doordash driversor any self-employed individualsis deducting your non-commuting business mileage.

If you made more than 600 working for doordash in 2020 you have to pay taxes. If you expect your tax liability to be more than 1000 for the year then the federal government mandates. Not very much after deductions.

Here is a roundup of the forms required. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. Internal Revenue Service IRS and if required state tax departments.

These factors can change between the time. So if you drove 5000 miles for DoorDash your tax deduction would be 2875. How are Taxes Calculated.

You will have to pay income tax on that money at your regular income tax rate. The time and date of the purchase. The type of item purchased.

Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. That 30 is to cover not only self-employment taxes153 for Social Security and Medicare but also Federal income tax and state income tax. If you owed on the full 1000 thatd be about 150.

Delivery Apps Like Doordash Are Using Your Tips To Pay Workers Wages Doordash Product Launch Refugee

11 Ways To Improve Your Doordash Customer Rating Doordash Improve Yourself Rate

Doordash Recommends A Tip Of 30 Doesn T Even Give 20 As A A Default Option R Assholedesign

Filing Independent Contractor Taxes For Food Delivery Drivers Tax Write Offs Tax Help Independent Contractor

Chart Doordash Builds On Pandemic Gains In 2021 Statista

Doordash Dasher You Can No Longer See Tip Earnings Youtube

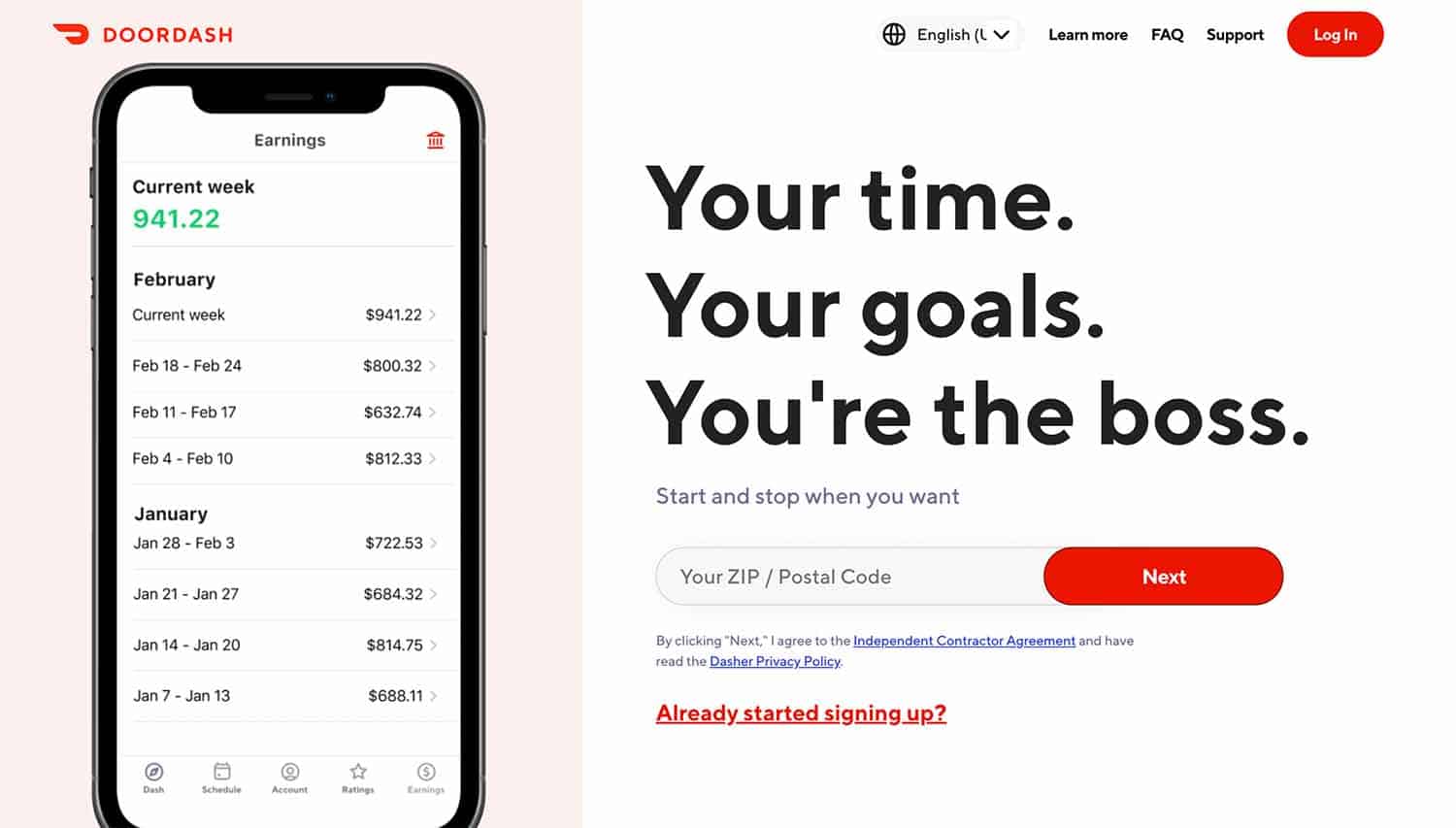

Become A Driver Deliver With Doordash Alternative To Hourly Jobs Hourly Jobs Money Making Jobs Doordash

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

How To Make 500 A Week With Doordash 2022 Guide

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

How To Do Taxes For Doordash Drivers 2020 Youtube

What S Happening With Doordash Stock

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Federal Income Tax Income Tax Tax

Doordash Driver Says She Makes 1 900 A Week Sparking Debate

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Delivering For Grubhub Vs Uber Eats Vs Doordash Vs Postmates Youtube Postmates Doordash Uber

New Fee Structure At Doordash Could Cost Customers More

How Many People Use Doordash In 2022 New Data

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educational And Informational In 2022 Tax Guide Tax Doordash