property tax in nice france

Legal advice property tax in France Nice French Riviera FISCAL AND ASSETPROPERTY RESTRUCTURING CM-Tax law firm based in Lyon and Aix en Provence assist his clients all. The taxe dhabitation is an annual residency tax which is imposed on the individual who is resident in the property on the 1st January.

In Depth Guide To French Property Taxes For Non Residents Expats

France levies two types of property taxes.

. If your property income from furnished rentals is less than 70000 in revenue per year you may benefit from the micro regime. Property tax on built properties on undeveloped land and the tax or charge on household waste. Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe.

In French its known as droit de mutation. Contact 33 1 83 79 32 99. There is several kinds of French property taxes.

That is to say that you declare everything you have received. The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households. Payments to the local administration will be.

Taxe foncière property tax payable by all owners in France is deductible from the value of the relevant property. The two main property taxes are. You are liable for this tax if the net value of your property in France exceeds 1300000 euros.

The NICE PROPERTIES group is an independent structure specializing in the sale of luxury apartments and prestigious villas on the Côte dAzur. Stamp duty is a tax on buying a house. We are present on the real estate.

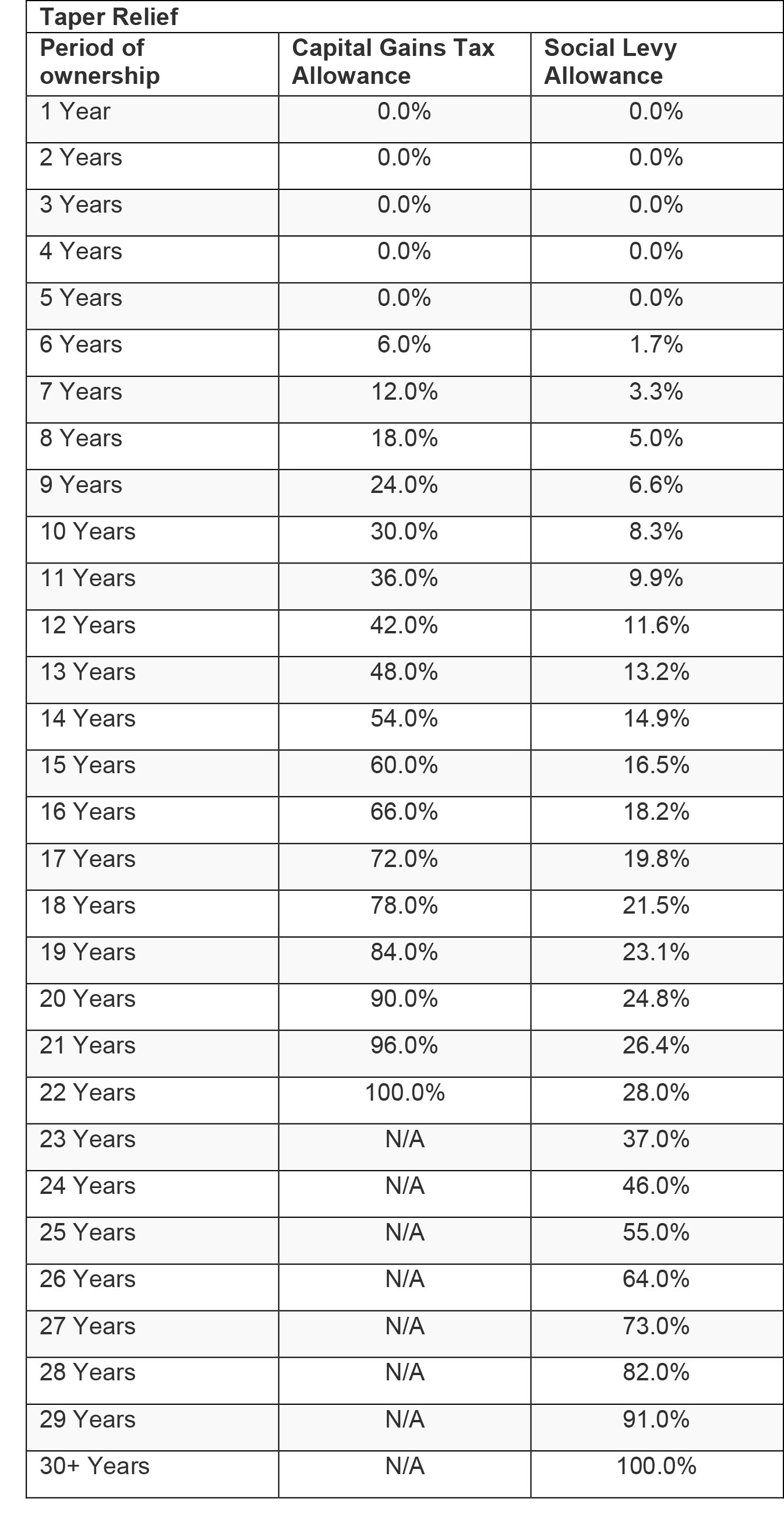

- casual earnings are subject to income tax at a 128 rate plus 172 social contributions ie. Since the fourth quarter of 2020 the. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

Earnings from the sale of cryptocurrencies are taxable and have to be declared in France. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. The rate of stamp duty varies slightly between the departments of France and depending on.

In the third quarter of 2021 over one year the upward acceleration of prices of older properties in mainland France continues with 74. These include a departmental tax usually 45 of the purchase. Taxe foncière paid by the owners of property regardless of whether they live there and taxe dhabitation paid by the property.

If my property is owned through an entity will this entity be subject to any taxes. If your property was acquired through an entity whether French or foreign this entity can be. Taxe dhabitation only applies to what the French.

The tax rate varies between 050 and 150 of the declared value of the. When it comes to completing a French tax. Utility tax 1253 departmental tax 1242 special tax 0205 garbage collection tax 950 administrative costs 60 euros.

An International Comparison Of Real Estate Property Taxes Eye On Housing

Understanding French Property Tax

French Taxes I Buy A Property In France What Taxes Should I Pay

France Crypto Is Now Moveable Property Tax Down From 45 To 19 Percent

Taxes In Nice France Teleport Cities

Brexit Second Homes In France What You Need To Know

What Are Property Taxes Like In The South Of France Mansion Global

Understanding French Capital Gains Tax Cgt On Property Sales The Good Life France

Property Tax Assistant Average Salary In France 2022 The Complete Guide

French Property Taxes Set To Reach Record Levels In 2022

French Property Hi Res Stock Photography And Images Alamy

French Property Tax Hikes Scheduled For 2022

French Property Income Tax Non Resident Tax Return Filing Pti

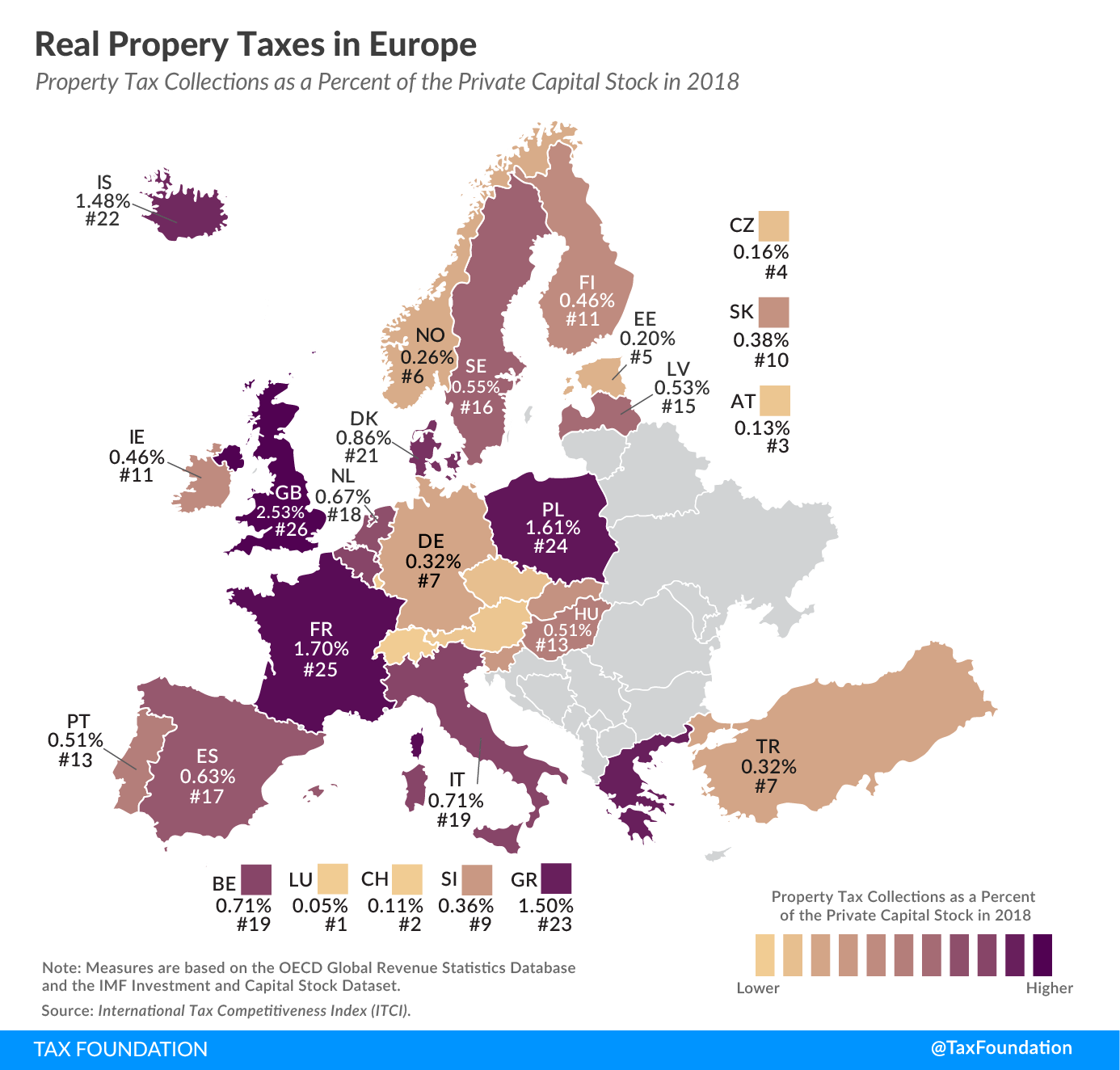

Real Property Taxes In Europe European Property Tax Rankings

Are Property Taxes Going Up In France Mansion Global

Own A Holiday Home In France This Ultimate Tax Guide Is For You

French Taxes I Buy A Property In France What Taxes Should I Pay