tax consultant salary philippines

This is 3 lower -16952 than the average income tax consultant salary in Philippines. In addition they earn an average bonus of 22199.

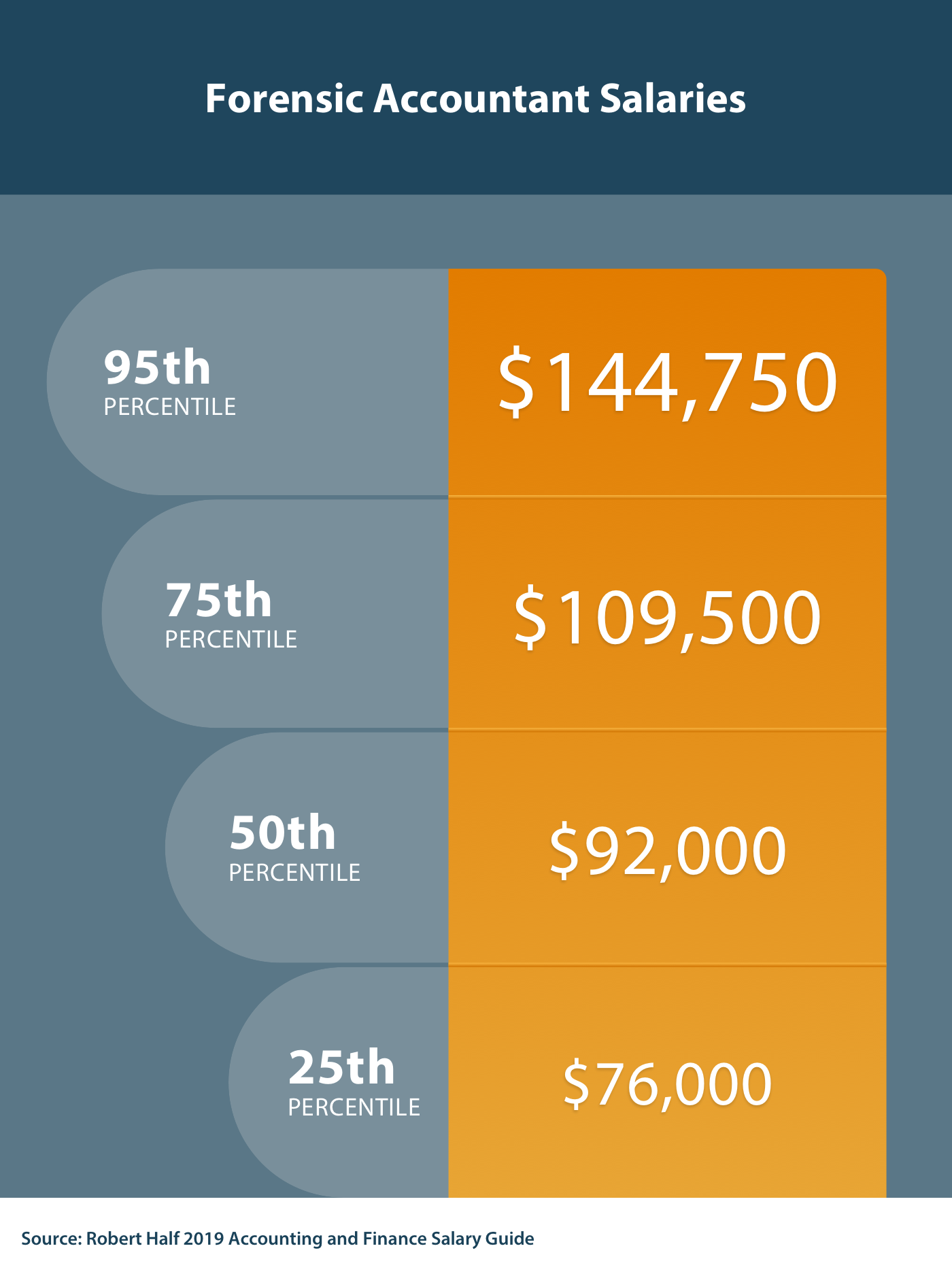

How To Become A Forensic Accountant 5 Steps To Consider

Learn about salaries benefits salary satisfaction and where you could earn the most.

. PHP 20000 - PHP 40000 a month. The average income tax consultant gross salary in Bacolod Philippines is 554700 or an equivalent hourly rate of 267. Accurate reliable salary and compensation comparisons for Philippines.

The average salary for a Consultant is 32975 per month in Philippines. Visit PayScale to research tax analyst salaries by city experience skill employer and more. Tax Associate salaries in Philippines.

Click on Calculate button. Salaries can range from PHP 125000 - PHP 143700. The average salary for a Tax Analyst with Tax Consulting skills in Philippines is 180000.

Searches related to tax consultant jobs. The average income tax consultant gross salary in Philippines is 554987 or an equivalent hourly rate of 267. The average salary for a Tax Consultant in Philippines is 240000.

These numbers represent the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. New Tax consultant Jobs in Philippines available today on JobStreet - Quality Candidates Quality Employers. Tax Consulting - Salary - Get a free salary comparison based on job title skills experience and education.

For more info please consult the Employment Section. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Philippines. In addition they earn an average bonus of 21190.

An entry level consultant 1-3 years of experience earns an average. The average salary for a consultant is 32975 per month in Philippines. What salary does a Tax Consultant earn in your area.

Competitive Salary Career Progression and Work Life Balance. In addition they earn an average bonus of 16334. The average consultant gross salary in Philippines is 574626 or an equivalent hourly rate of 276.

When factoring in additional pay and benefits Senior Tax Consultant in Philippines can expect their total pay value to be on average PHP 135000. Learn about salaries benefits salary satisfaction and where you could earn the most. The estimated total pay for a Consultant is PHP 122000 per year in the Philippines area with an average salary of PHP 45000 per year.

The average salary for a Tax Accountant is 42523 per month in Philippines. How to use BIR Tax Calculator 2022. A 2015 study by Price water house Coopers showed that the Philippines has one of the most difficult processes for paying taxes in the world as well as the highest income tax rate in Asia.

The results will be displayed below it. An entry level income tax consultant 1-3 years of. This is 1 higher 8195 than the average income tax consultant salary in Philippines.

An entry level property tax consultant 1-3 years of. 58812 Tax Consultant Salaries in Remote Philippines provided anonymously by employees. BIR income tax table.

Learn about salaries benefits salary satisfaction and where you could earn the most. Tax consultant to the head office personnel and branches. The estimated additional pay is PHP 77000.

In addition they earn an average bonus of 28501. Secure BIR tax clearance on LOA examination. Learn about salaries benefits salary satisfaction and where you could earn the most.

How does this pay data of PHP 135000 look to you. See popular questions. The average salary for a Tax Associate is 23076 per month in Philippines.

The typical Senior Tax Consultant salary is PHP 30000. Visit PayScale to research tax consultant salaries by city experience skill employer and more. 365 Tax Consultant Salaries provided anonymously by employees.

The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Philippines. The average salary for a Financial Consultant is 41609 per month in Philippines.

Was the salaries overview information. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Philippines. The average income tax consultant gross salary in Tacloban Philippines is 529757 or an equivalent hourly rate of 255.

The average salary for a Tax Accountant in Philippines is 397858. Businesses have to pay around 36 different fees and taxes annually. Please enter your total monthly salary.

The average income tax consultant gross salary in Philippines is 554987 or an equivalent hourly rate of 267. Percentage tax An independent consultant shall be required to pay the percentage tax of 3 if his gross receipts for the year do not exceed P1919500. In addition they earn an average bonus of 22188.

Visit PayScale to research tax accountant salaries by city experience skill employer and more. The average property tax consultant gross salary in Philippines is 408338 or an equivalent hourly rate of 196. What salary does a Tax Consultant earn in Remote.

![]()

How Much Are Accountant Salaries In 2022 Starting Salaries Raises

How Much Does An Accountant Earn Accounting Earnings Salary

Average Salary In Mexico 2022 The Complete Guide

How Much Do Data Analysts Make Data Analyst Salary Guide

Tax Manager Average Salary In Philippines 2022 The Complete Guide

The 2020 Pharmacist Salary Guide The Happy Pharmd

Bain Salary By Positions Locations 2020 Mconsultingprep

How Much Do Data Analysts Make Data Analyst Salary Guide

The 2020 Pharmacist Salary Guide The Happy Pharmd

How Much Do Data Analysts Make Data Analyst Salary Guide

Accountant Average Salary In California 2022 The Complete Guide

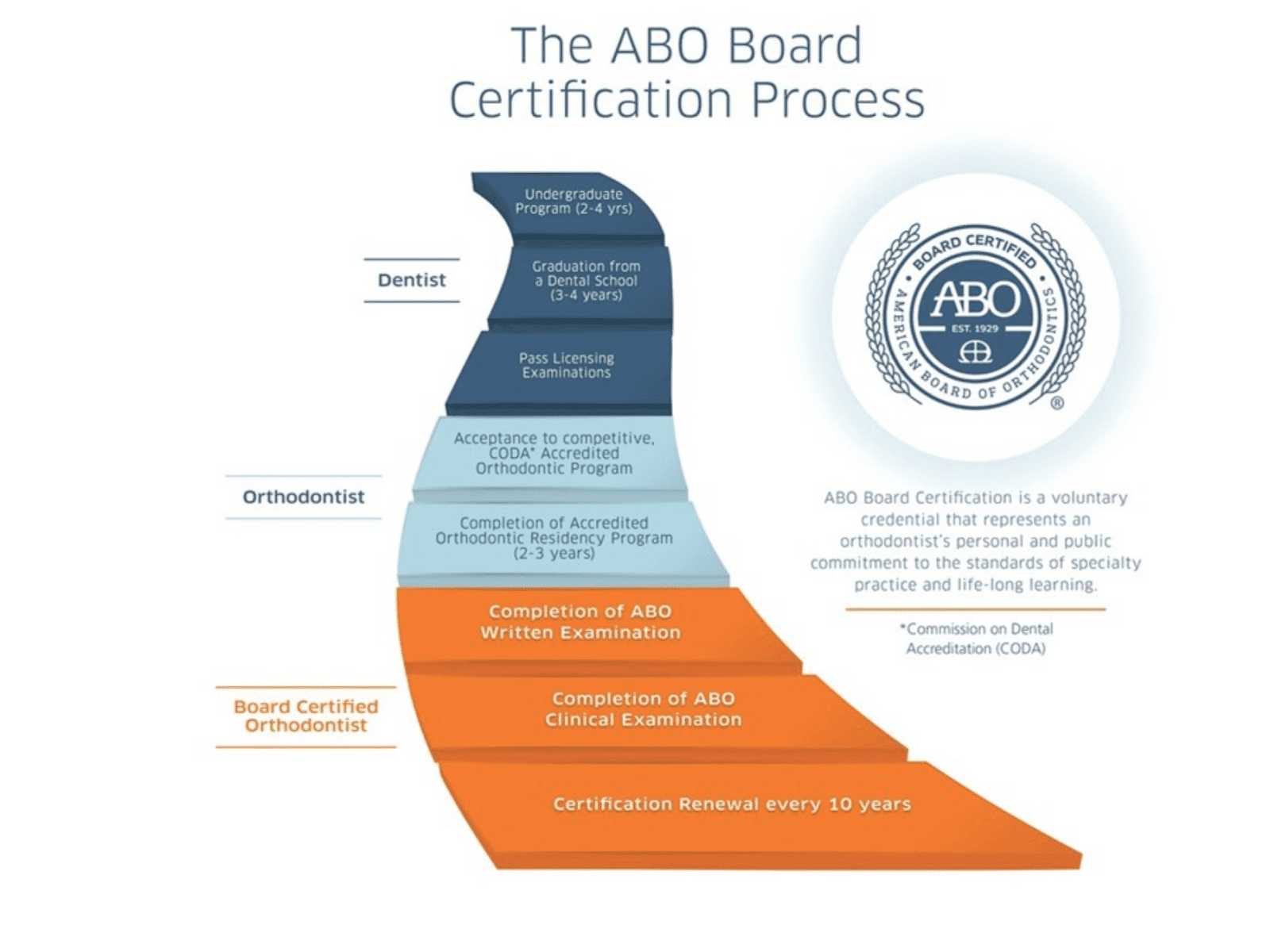

Orthodontist Salary Is It Worth The Student Debt Student Loan Planner

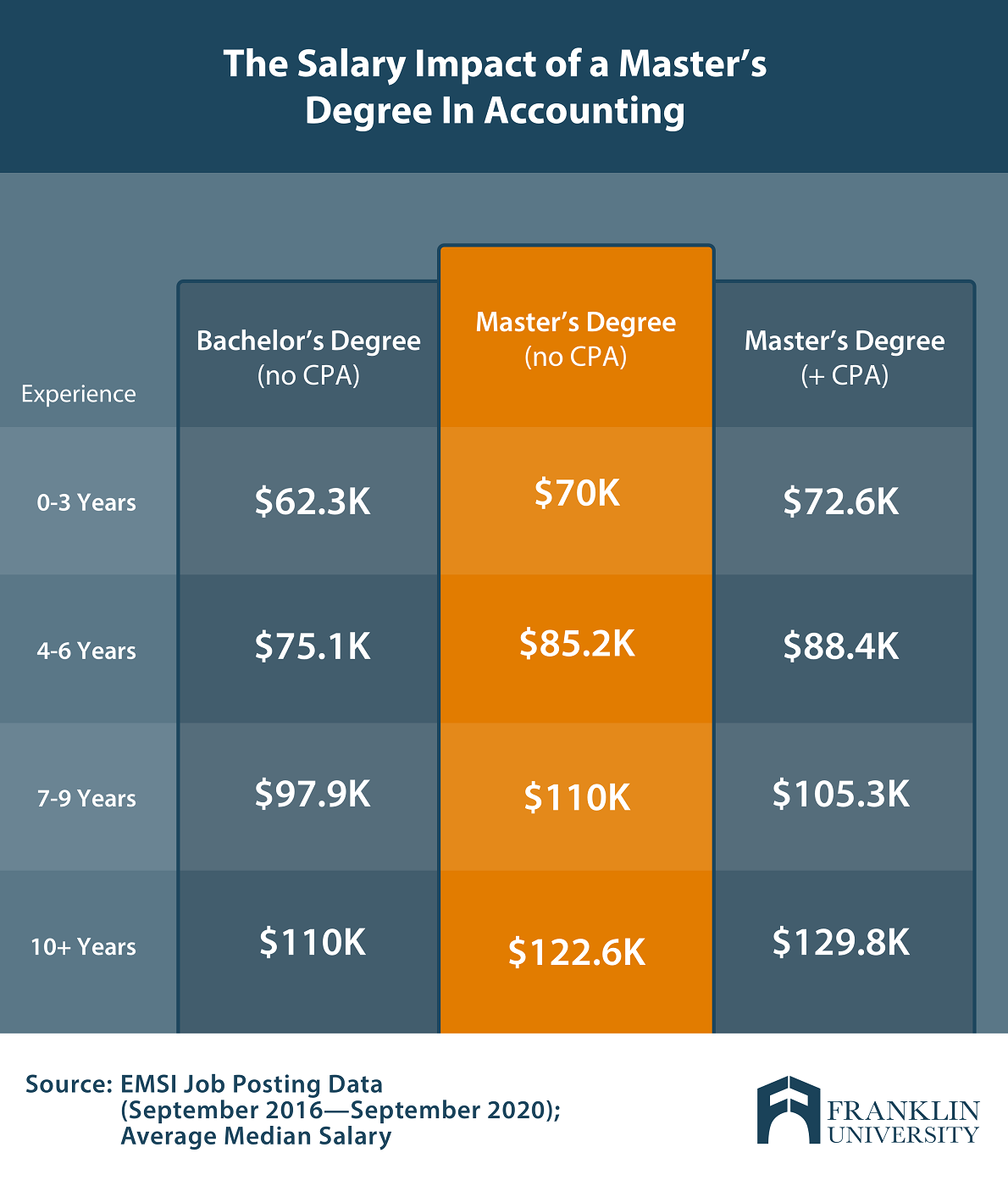

Master S Degree In Accounting Salary What Can You Expect

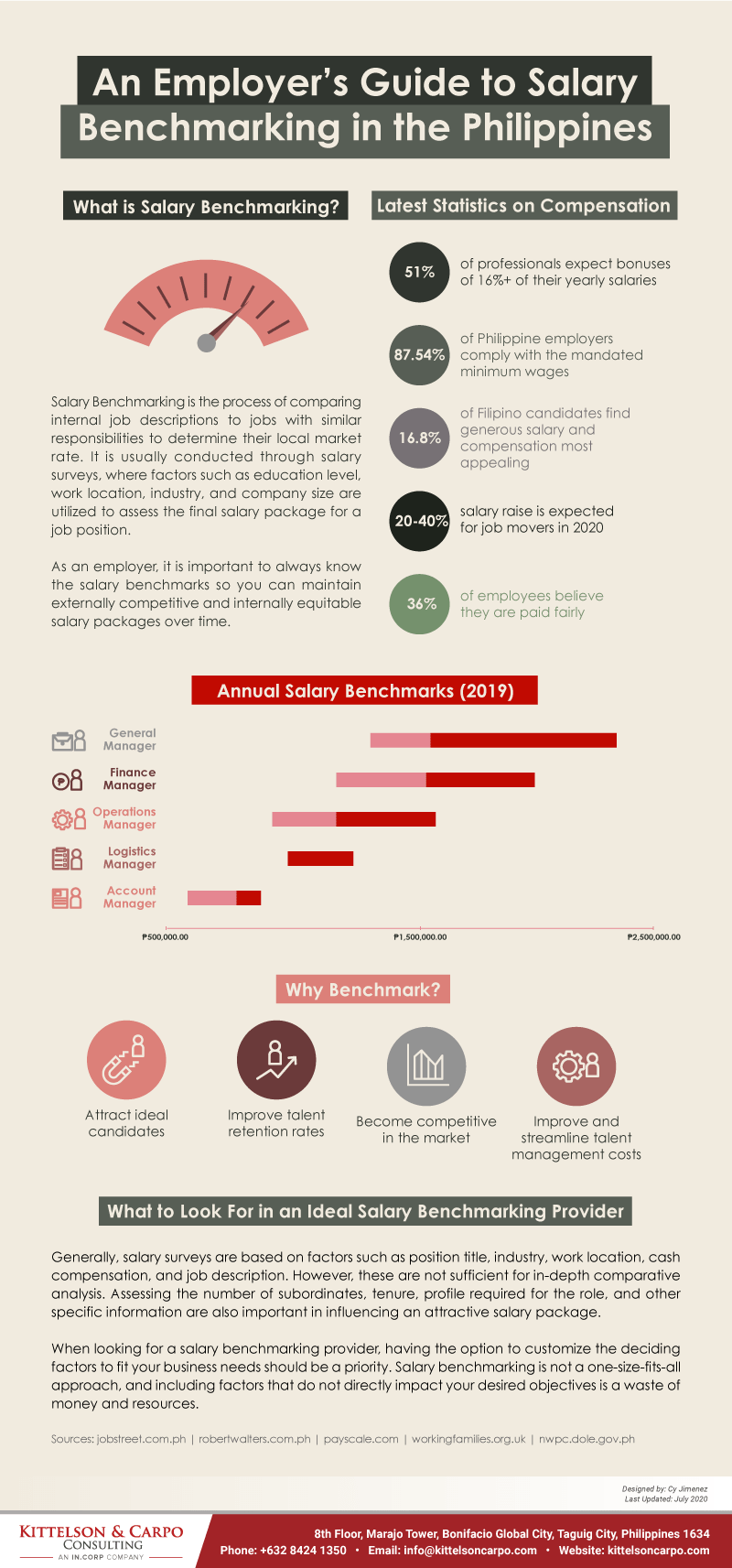

An Employer S Guide To Salary Benchmarking In The Philippines

Comprehensive Guide To Virtual Assistant Salaries In The Philippines Onlinejobs Ph Blog

Salary Structures Creating Competitive And Equitable Pay Levels